Introduction

In the era of forex trading the stories are explained by the numbers not by the man himself. When a man makes a successful trade, there is a strategy and method behind it. Nothing is achieved blindly. Successful traders always follow the rules and strategies.

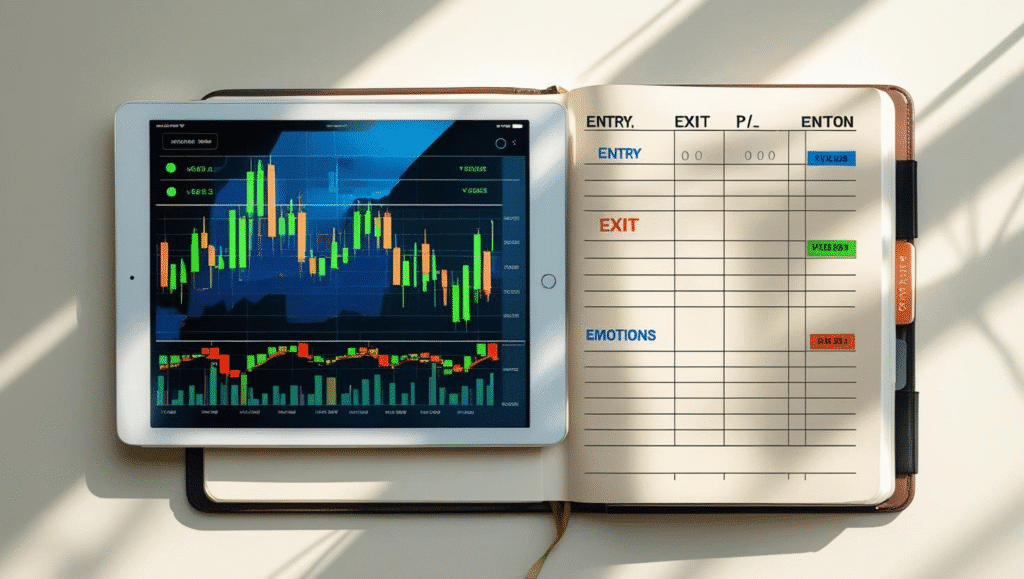

So now the question is what is the hidden thing behind the traders that helps them make successful trades everyday. The answer is so simple it’s a trading journal

In 2025, when algorithms, bots, and signals dominate the scene, real human discipline still wins. And it starts with one habit: journaling your trades.

In the era of a lot of chatbots and tools, we cannot follow the discipline by just relying on the apps and chatbots. Every trader should use his/her own mentality and discipline to become the successful trader. One thing you should make your habit of is your trading journal.

-

What a forex trading journal is and why you need one

-

What to include in your journal

-

The benefits of journaling your trades

-

A free Google Sheets trading journal template

-

Step-by-step instructions to use it effectively

Let’s dive in.

What Is a Forex Trading Journal?

A journal is the record of your trades. Don’t mix it up with a boring Excel sheet.

This will cover the record of all your trades. Your trading journal will be your teacher as well because you will see your wins and losses in this journal. It will teach you that last time what your strategy was last time that made you successful, and if this time I am making the trade, am I following that strategy or not? As we all know that trading is all about following your strategies. In this way trading journal is your best partner. Get yourself married to this partner. It will not leave you alone, hahah.

At its core, a trading journal helps you answer questions like:

-

Why did I take this trade?

-

What was the result?

-

Was the setup valid?

-

Did I follow my rules?

-

What can I improve?

It becomes your trading diary—a space where you learn from your own experience.

Why You Need a Trading Journal in 2025

Why You Need a Trading Journal in 2025

If you are a trader who just relies on guesswork, then you cannot become a successful trader. Trading is all about confirmation. Confirmation of what? It’s the confirmation of your entry, your exit, your TP, and stop loss as well. Before your entry, you confirm all your steps of trade. For confirmation and to keep a record of your trades, you need a trading journal.

A trading journal in 2025 isn’t optional—it’s essential. Here’s why:

1. Accountability

You can’t improve what you don’t measure. A journal holds you accountable to your strategy and emotions.

2. Pattern Recognition

You’ll begin to spot patterns in your trades: which pairs perform best, what timeframes suit you, and which strategies fail consistently.

3. Improved Risk Management

With journaling, you become aware of how much you’re risking per trade—and whether your wins justify your losses.

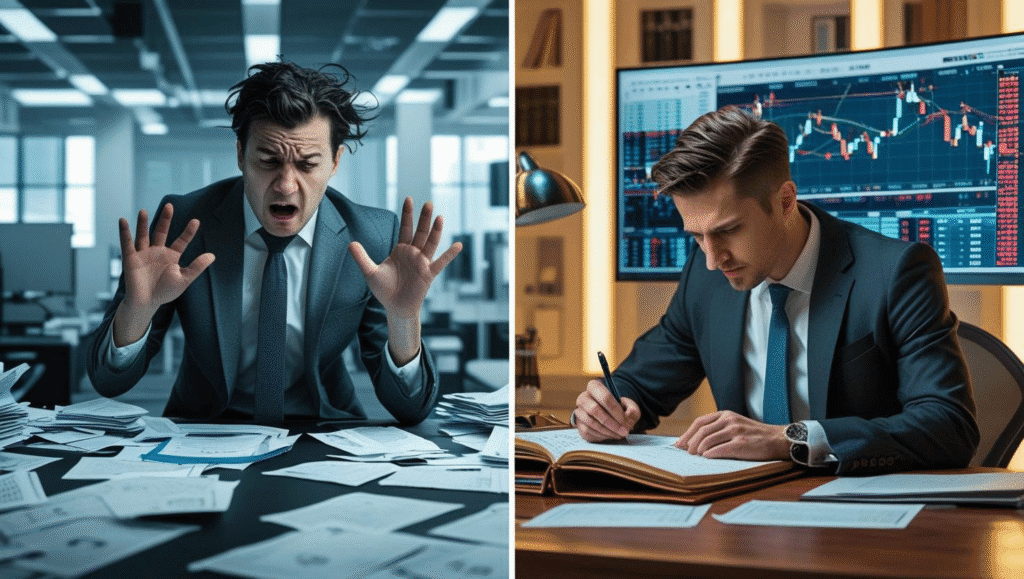

4. Emotional Control

You’ll notice when you’re revenge trading, overtrading, or trading out of fear. Awareness leads to control.

5. Confidence Boost

Seeing your progress written down builds trust in your system—and in yourself.

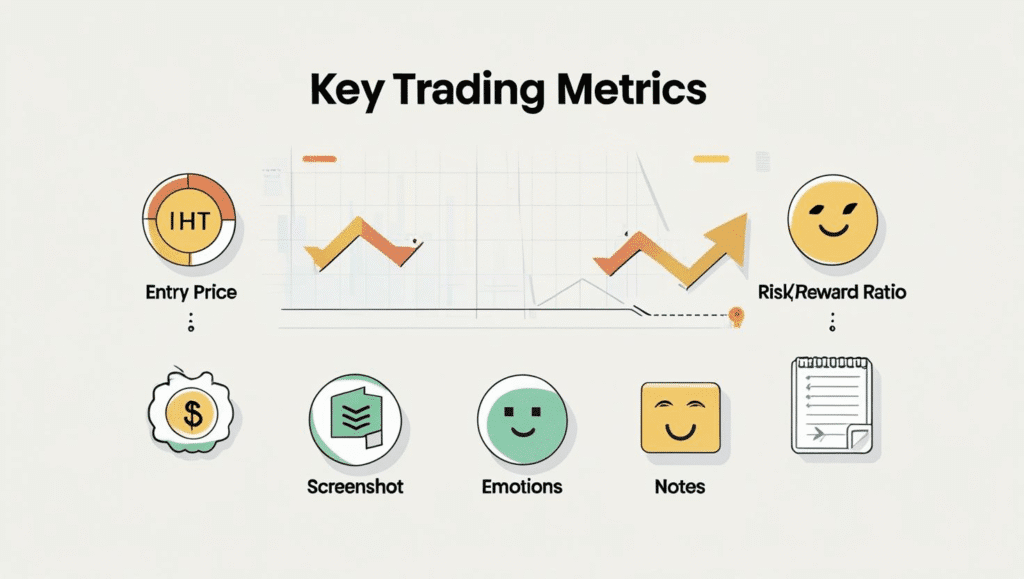

What Should Be in a Forex Trading Journal?

Here’s a simple yet powerful structure to follow in your journal. You can do this on paper, Excel, or Google Sheets (we’ll give you a free template below).

|

Column |

Description |

|

Date |

When the trade was executed |

|

Time |

Exact time of entry |

|

Currency Pair |

e.g., EUR/USD, GBP/JPY |

|

Trade Direction |

Long (Buy) or Short (Sell) |

|

Entry Price |

Price at which you entered |

|

Exit Price |

The price at which you closed the trade |

|

Stop Loss |

Your SL value |

|

Take Profit |

Your TP target |

|

Lot Size |

The volume traded |

|

Pips Gained/Lost |

Total pips earned or lost |

|

Profit/Loss ($) |

Financial outcome of the trade |

|

Risk-Reward Ratio |

Helps evaluate trade quality |

|

Reason for Entry |

Technical or fundamental basis |

Free Forex Trading Journal Template

We’ve created a ready-to-use, customizable forex trading journal template for you.

✅ Track every trade with detailed fields

✅ Monitor win rate, average profit, and R: R ratio

✅ Includes automated P/L summaries

✅ Easy to duplicate for multiple months

✅ Beginner-friendly design

How to Use the Journal Effectively

Having a journal is step one. Using it with intention is what brings results. Here’s how to get the most out of it:

1. Update It Daily

Journal your trades the same day—or within a few hours. Delaying it reduces accuracy and learning.

2. Be Honest With Yourself

Don’t sugarcoat your losses or skip emotional notes. This is for you, not the public.

3. Review Weekly & Monthly

Look for patterns: What strategies worked best? What times were most profitable? Where did you make emotional decisions?

4. Track Performance Metrics

Use formulas to calculate:

- Win Rate

- Average R:R

- Total Profit/Loss

- Most Traded Pairs

5. Note Emotions & Lessons

Did you panic exit? Ignore your plan? Get greedy? Write it down. These reflections build discipline.

6. Set Improvement Goals

Based on your review, set a simple weekly improvement target:

- “This week, I’ll wait for candle close before entry.”

“I’ll limit myself to 3 trades per day.”

Common Mistakes to Avoid When Journaling

Even with the best tool, some habits ruin the impact. Watch out for:

❌ Skipping trades after losses

❌ Only writing down numbers, not emotions

❌ Editing or deleting losing trades

❌ Using too many unnecessary columns

❌ Not reviewing your journal regularly

Remember: The journal is a growth tool, not a scoreboard.

Real Trader Tip: Treat It Like a Business

Would you run a business without financial records? Then don’t trade without a journal.

Every serious trader keeps records. They treat their capital like a business asset—not a gamble.

Your journal helps you:

- Optimize your best strategy

- Identify weak areas

- Protect your capital

Scale with confidence

Conclusion: Make 2025 the Year You Trade Smarter

If you’re serious about forex trading in 2025, start with the basics—and that means tracking your trades.

A forex trading journal isn’t just a template. It’s a roadmap to consistency, confidence, and ultimately, profitability. Use the Google Sheets template provided, build a routine around it, and make journaling part of your daily trading ritual.

No matter how many tools, indicators, or signals you use—nothing beats the clarity that comes from looking at your own performance.

So go ahead, download the journal, start logging, and trade like a professional.

Happy journaling—and even happier trading!